The new year has begun by seeing more and more people living paycheck to paycheck and struggling to pay their bills. Many have been shocked to see what their monthly spending has amounted to, and experts have found that even those who earn more than $100,000 each year have been struggling. The reason behind this is simple. Inflation has affected nearly every household in the US, with lower-income households being hit the hardest. The number of homeless people has increased as prices have increased. In many areas, rents are unaffordable, forcing many to downgrade or move to a different area.

The average household has had their expenses go up several hundred dollars each month, and because this comes out of required living expenses, there is less to go around for savings or discretionary spending. For many, creating an emergency fund is out of the question. Many have already dipped into their emergency savings. It won’t be surprising, then, to hear that consumers are cutting back. Looking at the situation closely reveals that many areas of daily life have already been affected. Over the holidays, fewer people chose to travel, and of those who did travel, many chose to drive instead of fly.

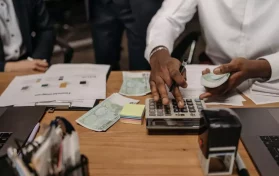

How Americans Are Organizing Their Finances

Because of how tightly many are being forced to live, Americans are organizing their finances better than before. Getting them in order allows consumers to see how much they have and where they need to adjust. They are also getting creative when it comes to how they go about this. Some are taking out personal loans to get their spending in order. A personal loan can be used for living expenses, travel, debt, or anything else the funds are needed for. Often, personal loans can be a great way to get finances in order.

How Are Consumers Using Coupons?

Consumers have been shopping for items on sale and planning their meals around these items. There are both independent and store apps that show weekly coupons and deals to save money. Some store apps personalize their offerings based on what customers have purchased most often before. Experts recommend checking store websites and apps to see if any coupons are being offered for needed items that week. When items are on sale, consumers can decide to have these items instead of other ones.

Consumers can also shop final sale shelves at stores like Safeway or King Soopers. They can find items with longer shelf lives, like canned goods, flour, sugar, pasta, or bread. These might be the last of their kind in stock that the store wants to unload, or they may be slightly damaged. Canned goods may have slight dents in them, and in return, the store offers a discount for purchasing them.

Getting Creative About Dealing with Shortages

Many stores have been seeing an increased demand for store brand products. In some, shelves of store brand products are bare and only the name brand equivalents remain. To avoid spending even more, consumers are getting creative about dealing with these shortages. In many stores, blocks of cheese tend to be less expensive than bags of shredded. Because it tends to be more work to shred one’s own cheese, blocks may remain when bags of shredded have sold out. More people have been purchasing frozen fruits and vegetables instead of fresh. They have a much longer shelf life, which can significantly reduce food waste. The same is true of canned goods, which experts explain can be just as nutritious as their fresh equivalents.

More People are Dipping into 401(k) Plans

More consumers are starting to take advantage of their retirement savings early to pay the bills each month. These retirement savings are being used to prevent evictions or foreclosures as other bills increase, and some are using their savings to pay their medical bills, as this is another area that has become more expensive over the past year. However, financial experts are warning against making this costly mistake.

Dipping into your retirement savings means you are taking income away from your future self. As you near retirement age, you will regret this decision, and you may not have enough to live on at that time. A retirement plan should not be used as a source of extra money. Before inflation ramped up, people would dip into their retirement savings or take a trip or otherwise treat themselves. But now, they are doing it to meet their daily expenses.

A retirement plan is a finite source, and dipping into it to meet your everyday expenses is not sustainable, especially if you are unable to replenish. Still, that doesn’t mean some consumers are not able to reset. Near the end of 2022, not many people were able to purchase holiday gifts for friends or family members. But now, more people expect their income to increase, even if it does not increase quickly enough to keep up with inflation.

Even though paychecks are not increasing as quickly as needed, some people may be experiencing better financial situations. More people are cutting back on things that were not critical to spend money on. While eating lunch at work is necessary, more consumers have been bringing their own food instead of buying it there. This adjustment in spending has been eye-opening for many, showing the world it is not as important how much someone earns. The important thing is what one does with their earnings.

Americans have been looking closer at their financial situation to determine where they can cut down expenses and how they can delay large purchases. This can mean everything from cars to vacations to appliances will likely be in less demand this year. There is already pressure when it comes to services. Over the holidays, beauty services and restaurants are usually in high demand, but they took a slight hit at the end of 2022 and start of 2023. Decisions to cut back have continued to impact the economy as consumers continue to adapt their spending.