On Wednesday, the Senate passed the CHIPS+ Bill, which is now slated to go into the House for a final vote. If passed, it will then go to the Oval Office for President Joe Biden’s signature.

The bill has been considered controversial for many reasons, but the one that has garnered the most attention has to do with Speaker Nancy Pelosi (D-CA). Pelosi’s husband Paul, who has garnered much of his wealth trading stocks, bought between $1 million and $5 million in NVIDIA stock just a few weeks ago. Critics say that Paul Pelosi could be making purchases based on “pillow talk” knowledge of when a Congressional vote would be had on the CHIPS+ bill.

The question many Americans are asking has to do with what is in the bill, and how could any legislation prop up stock prices of the NVIDIA company.

So, let’s take a look at what’s in the CHIPS+ bill.

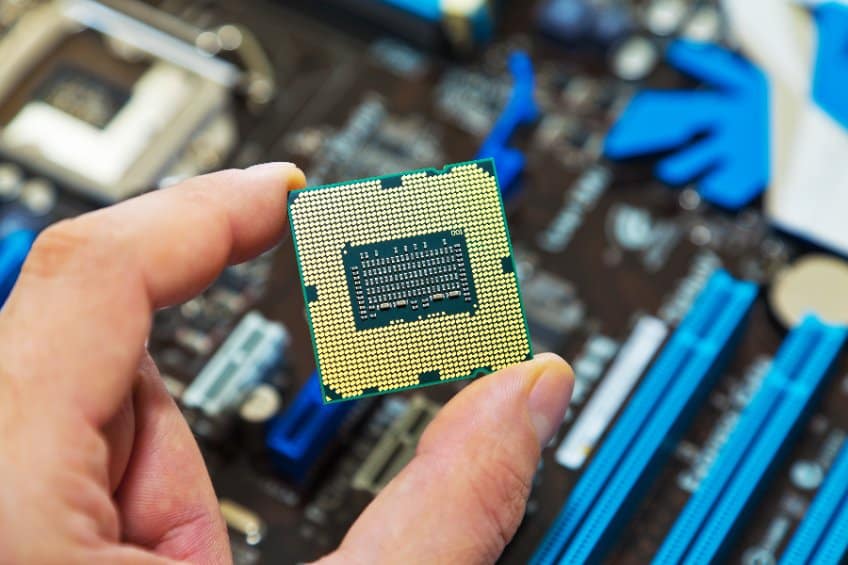

The bill is intended to “shore up U.S. competitiveness with China” in regards to manufacturing semiconductor chips. These chips are in many of the everyday products we Americans use daily, including vehicles and electronics. In order to increase production, the bill will provide up to $50 billion in subsidies for companies in the semiconductor chip industry.

NVIDIA manufactures GPUs, or graphic processing units. Back in March, however, a Reuters article featured the CEO of NVIDIA saying that the company is “interested in exploring using Intel Corp (INTC.O) for manufacturing its chips.” Currently, a company in Taiwan manufactures the semiconductor chips utilized by NVIDIA.

Of the $50 billion intended for semiconductor industry companies, $39 billion is specifically set aside for “building, expanding, or modernizing domestic facilities for chip making.” The remaining $11 billion is intended to bolster research and development.

Most expect the bulk of the money to go Intel, who postponed breaking ground on a facility in Ohio with the promise that they would move ahead with the construction if the CHIPS+ bill passed.

However, Yahoo is reporting that Texas Instruments, Samsung, Micron Technologies, and Global Foundries may also receive some funding.

The bill also includes tax credits to companies for “investment.” Companies would need to invest in workforce training, future innovation, and defense initiatives as well as the U.S. mobile broadband market.

The bill specifically mentions “an effort to promote non-Chinese 5G equipment manufacturing.”

The Advanced manufacturing Investment Credit portion of the bill would establish a 25 percent tax benefit for the manufacturer of semiconductor chips. Proponents of the bill say that “this will allow the U.S. to catch up in the global semiconductor manufacturing race.”

In 1990, the United States manufactured as much as 40 percent of the world’s semiconductor chips; by 2021, this number fell to twelve percent.

In 2019, one hundred percent of semiconductor chips were manufactured outside the United States.

Bernie Sanders joined a majority of Republicans in opposing the bill. Both Sanders and Republicans hold that this is providing subsidies for companies that do not need them while Americans fight 9.1 percent inflation.